The future fiscal cost of ‘generation rent’

Stephen Clarke is a senior economic analyst at the Resolution Foundation. Yesterday, they produced a report which revealed the issues facing young people in the housing market.

Stephen Clarke is a senior economic analyst at the Resolution Foundation. Yesterday, they produced a report which revealed the issues facing young people in the housing market.

For most people, the lion’s share of their income is spent housing and so forking out on accommodation when no longer earning would seem like a tall order for many. The vast majority of retired people own their own home and so have relatively low housing costs, however, a significant minority (around 23%) rent and many of these people have some or all of their housing costs paid by the state.

Housing benefit helps those in private and social rented accommodation. People who own their own home and those who have assets worth more than £16,000, and who are not eligible for Pension Credit, do not receive housing benefit. Furthermore, those in institutional accommodation (care homes) also do not qualify. Last year 1.3 million pensioners claimed housing benefit, amounting to £6.3 billion.

How much we’ll have to spend on housing benefit for those in retirement in future depends on a number of things, including the size of the pensioner population, their income, and what type of accommodation they live in. So far most analysis has focused on the impact that an ageing population could have on the housing benefit bill. The Department for Work and Pensions and the Office for Budget Responsibility’s own analysis, last carried out in early 2017, suggests that an older population will mean more pensioners claiming housing benefit, but that spending will fall as a proportion of GDP. However – aside from some analysis by the Strategic Society Centre – less attention has been paid to the possible impact of changing tenure patterns. Indeed the government’s own analysis assumes that the tenure patterns of the future pensioners will be much the same as for the current generation.

However, previous work for the Intergenerational Commission has suggested that this may not be the case. Younger generations are finding it a lot harder to get on the housing ladder and it is uncertain if the low homeownership rates for younger people will be reversed over the next decade, even if some of these people will inherit property wealth from their parents. Our estimates suggest that if recent conditions persist as few as 47% of millennials (those born between 1981 and 2000) may own their own home by the time they reach 45. Some of the remaining 53% may inherit property wealth that they can use to get on the housing ladder, but even under relatively optimistic assumptions this is, only likely to increase homeownership rates in retirement to around 66%. Now of course we could instead see a return to economic conditions similar to those that existed when it was a lot easier to purchase one’s home, but even under this (extremely) optimistic assumption it is unlikely that homeownership for millennials will reach the rate (77%) for current retirees.

To get a sense of the possible impact that different tenure patterns could have on the pensioner housing benefit bill we have used our projections for housing tenure over the next decade, with our estimates of the possible impact of inheritances, along with official population forecasts to estimate the bill in 2060, a point when the vast majority of millennials will be in retirement.

Our results are expressed in today’s spending terms because we are estimating how the housing benefit bill would change if everything but population and tenure were held constant. We take no view on whether or not the generosity of housing benefit will change, or whether more people will be housed institutionally, we are also not forecasting how the economy and pensioner incomes will evolve over the next four decades (a full explanation of our methodology is provided in a link at the bottom).

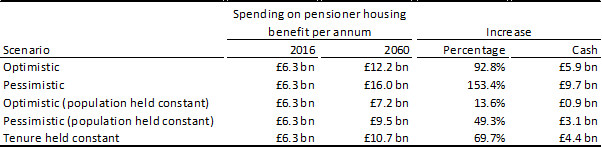

The results are provided below. The optimistic scenarios are based on the assumption that 73% of millennials will own their own home in retirement, the pessimistic scenarios assume that just 66% will. The fifth and sixth rows strip out the impact that an ageing population has, while the seventh row isolates the impact of demographic changes by holding tenure constant.

A few things stand out. The first is that the ageing of the population has a significant impact, raising spending on housing benefit by approximately 70%. However, our pessimistic scenario shows that, stripping out the impact of an ageing population, tenure changes will still raise the housing benefit bill by around 50%. A similar magnitude as that caused by the demographic shifts.

A few things stand out. The first is that the ageing of the population has a significant impact, raising spending on housing benefit by approximately 70%. However, our pessimistic scenario shows that, stripping out the impact of an ageing population, tenure changes will still raise the housing benefit bill by around 50%. A similar magnitude as that caused by the demographic shifts.

The above should provide a sense of the impact that a rise in the share of pensioners renting in retirement could have on public spending. Though our estimates are only illustrative it is worth pointing out that a number of factors could boost or shrink these numbers. First, we assume a relatively high proportion of pensioners (18%) rent in the social sector. Current trends suggest that an increasingly small share of millennials rent socially, and should a higher proportion of pensioners rent privately in retirement then this would – under current policy – push costs up. On the other hand, we do not take account of the fact that – in a world in which the proportion of pensioners renting is far higher – the marginal ‘renting’ pensioner is likely to be wealthier and so perhaps qualify for less housing benefit. There are clearly both upside and downside risks to our estimate.

Although their results are produced using a different methodology (which amongst other things estimates how pensioner incomes and GDP will evolve over the next four decades) we can compare our estimates of the number of pensioners claiming housing benefit in 2060 to those produced by the OBR and DWP. Their assessment assumes little change to current tenure patterns and they estimate that 1.6 million pensioners will be claiming housing benefit in 2060. This compares to our assessment of 2.6 million under our optimistic scenario and 3.3 million under our pessimistic scenario. Inflating their figure to take into account the possible impact of a decline in homeownership suggests that around 2.2 million pensioners may end up claiming, which – although less than our estimate – still provides some indication of the impact that a fall in homeownership could have.

Predictions, not least those that attempt to peer forty years into the future, should always be taken with a pinch of salt. However, this exercise has drawn attention to something that has not been adequately included in discussions of the fiscal impact of an ageing population. The more older people who rent their homes, particularly in the private rented sector, the higher spending on housing benefit will likely need to be to support these people. We have documented how renting in the private rented sector often involves paying more, getting lower-quality accommodation, and enjoying less secure tenure, this analysis suggests that it may also cost the state a lot more in future.

This blog originally appeared on the Resolution Foundation’s website.